I have both a Dropbox and a Netflix subscription. The one I think about most is Netflix. It’s a fixed monthly fee that I know I can manage if my situation changes – and indeed have done – taking a break from Netflix for a while and using another streaming service, running two in parallel for a while and also canceling both for a while. It fits my mental image of what I think is best about the digital world. Flexible, get to see what I want, when I want – pay for use and stop when I want. But then there is my dropbox account. Maybe running at a 10th of the yearly cost of streaming services or less. However, I have spent a long time making sure dropbox is my safe haven for my family photos and videos. My backup of backups. Now running at family photos dating back to early 2000! Clearly, I could change in theory and it’s a flexible subscription if my circumstances changes. But it’s really a fiction. I won’t be dropping this subscription any time soon. There are too many lock-in points to make this anything but the most painful transition and I sincerely hope that I can always pay this amount and Dropbox does not go on a systematic price increase with me – because I fear I will have to say yes.

This leads me to wonder about what happens if my Dropbox lock-in becomes the dominate situation in the way we pay for our digital economy – particularly from a company perspective. What does this mean? Are companies at risk of creating a debt bubble, locking in uncompetitive cost structures and reducing profitability, as they accelerate their transformation towards the “digital economy”?

These are personal opinions and in no way reflect the situation or opinions of the company I work for.

The trigger for asking myself this question came from a UK Bank of England warning last month that a potential new debt bubble was emerging in the UK around personal debt, with one of the main drivers, this time, not being housing, but Personal Contract Plans for cars – or leasing to you and me.

A long way from the digital economy maybe.

However, my first reaction was to draw a connection – because car leasing – for me – seems a bit like my Netflix account. It gives limited financial exposure, ability to be flexible and walk away after a shorter period, rather than invest in an expensive asset, ability to pay per use (of a sort) with all risks taken care of, ability to change cars (technology) as they change on the market and so on.

Now someone, that I must admit knows a hell of a lot more about these things than I do, was saying something that felt like the opposite to my intuition. Car leasing could lead to more risk. Not less risk. And even a bubble. Clearly this is something to do with penetration – when PCP’s were not the main form of financing, no flags were raised – it is a problem because it is becoming a dominant model to pay for cars. So what’s going on? and can we use this case as a framework to look at what is happening in companies who are moving to a digital model? (which is most companies I know of).

Several elements were raised in the discussions around the Bank of England announcement – all being risks increasing rather than direct problems here and now. So here goes – I will take some elements gleaned from some articles and news items around the UK emerging risk in personal debt, and then attempt to take these over to the world of the digital economy and digital transformation that companies are now undertaking.

From the not so deep reading around the announcement on car leasing leading to personal debt, I have picked up three types of risk.

1) People lock away money into a higher fixed monthly payment, and the flexibility promised becomes a fiction.

Once in this system, a lot of people do not build up the capital to make the down-payments for loans to buy a car and PCPs offer a way to avoid large down-payments. This essentially means people must stay in the leasing system. Flexibility becomes a fiction (people must have a car) and a person becomes committed to a high fixed cost that cannot be varied. At best maybe they can move to lease a smaller car next leasing round.

This is different to when you buy your own car. The financing / debt part is a lower fixed outgoing – often a reasonable down payment is demanded with slightly more credit checks – and a lot of people will reach points during their ownership where they pay it all off and free up the money to other stuff. People are also able to some extent vary the monthly outgoings (and implicitly vary the risks) over time periods. Remember that time you skipped a year of “official services” and went without, or did not follow the garage advise buy new tires or whatever was recommended because it was not urgent. You could vary the commitment without giving up the car. Also, if pressed you could change your monthly outgoings quickly. Maybe sell and buy a similar car but older and with more mileage, using one to put a down payment on the other and cut immediate monthly outgoings.

2) People “over-pay”

The leasing structure encourages that we take the slightly better option – as they buy large numbers in bulk and for specific models / options offer very attractive monthly fees, without the person really feeling how much additional risk is being taken on, for what at the time seems an affordable small increase in fixed monthly outgoing. A big driver to this is that access to money is cheap – so that people are encouraged to do this and finance is almost always given.

3) People are still exposed to market risk – and the risk increases.

Most leasing build in some connection to the market changes to manage risk – in the PCP case it is tied to assumptions that the second-hand market prices for cars do not change a lot. If they change – people in the leasing will have to change their payments or maybe need to find additional money to cover the difference in order move to the next 3-year leasing. The system becomes sensitive, rather than robust, to particular kinds of changes – and often builds in its own pyramid effect and fulfills its own weak point. In this case if all move to leasing, the overall uptake rate for new cars goes up, and for a while drives new car growth. However, at the same time builds up a potential large negative correction of the second-hand car market as the market for these cars is undermined.

I am sure there are different leasing structures that help a little with different risks- but the end result is that a lot of people are locked into a specific form of financing that demands a fixed amount is taken out of people’s finances continuously with no break. These people must have a car, and can end up in a situation they must continue a leasing approach, and if suddenly they need to vary their fixed amount for other reasons, they are unable to. At this point the leasing becomes a personal debt issue and will play out as such in their lives. If everyone does it, and the system becomes very sensitive to specific type of correction (that the system itself will possibly trigger), then it’s a bubble that can burst.

Again, as always, a lot of simplification in this – but I think enough to set a frame to think about digital economy, and companies transitioning to this economy.

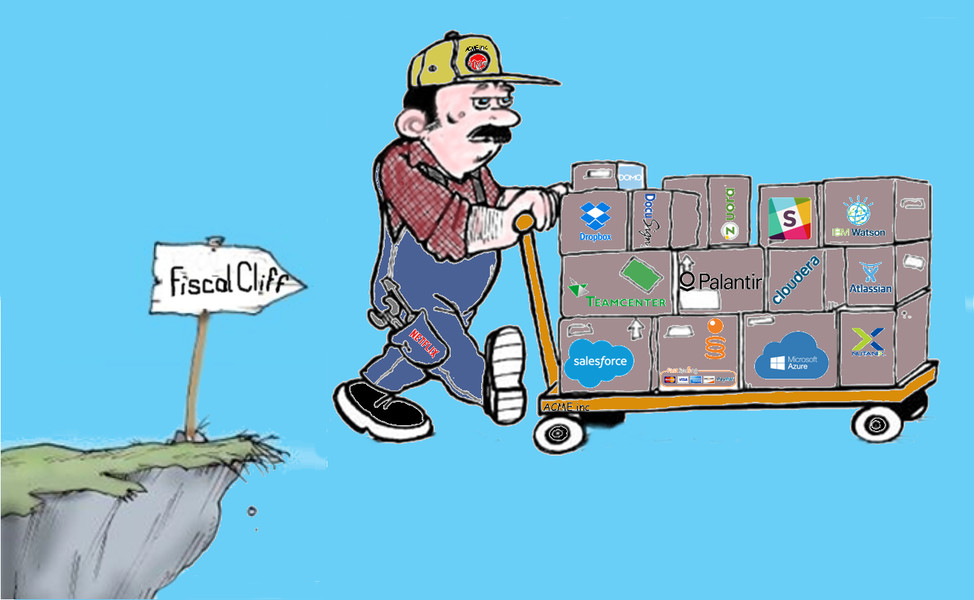

So, moving to this area – there are many business models in the digital economy – but that is not the point. The question is, are there any taking over as the dominant form, and does this have some of the same characteristics we see in the Personal Debt case above. If so, are we building up a company fiscal cliff?

If I look around at the business models that seem to be most in use in the company space – there are not a lot. The dominant approach seems to be a modified pay-per-use IT cloud solutions based offering to enable the company to be part of the digital economy -and its everywhere throughout a company. In its IT infrastructure, in its product/service sales systems and even in the actual core product/service offering itself. In terms of infrastructure, process or service, the cost is often tied to number of people using the service (think Salesforce). It might also be products/services a company uses to carry out functions to support for example R&D – or maybe storage space in data centers, then amount of times services are used or quantity used may be the payment metric (think Autodesk world of simulation and other tools with their token system for tool usage), or maybe its supporting sales transactions themselves , for example an e-commerce billing system like Fastspring – then it’s some % charge per sale amount like a credit card cost – often on top of a credit card cost if purchase is with a credit card (so a pay per use on turnover). Now we also see emergence of breakthrough tech. – for example a sensor that for certain types of applications embeds all that’s needed for a company to extend its product to sense more and transport that data to a cloud environment – but these companies are not selling the sensor to other companies as a variable cost direct material component – instead they sell the data cloud info as a pay-per-use / subscription type service and give the sensor as part of the fee.

The payment structures are clearly varied and build in discounts – but it’s likely to be a combination of a monthly base fee + a usage payment model + some enterprise discount as the usage parameter grows. All this looks basically like a kind of leasing set up to me – and one, like the PCP above, that is dominating and growing fast. This, of course, is not surprising as it fits the value selling “Netflix” mental model of what the cloud and internet is about, which is the one I think we naturally carry round in our minds – ensuring flexible “agile” company structure – scalable with use, avoid heavy maintenance, keep updated with latest functionality in the prices and so on.

There are other models like freemium and still a traditional standalone cost then fees to upgrade, as well as companies that basically build their own in-house solutions – but clearly standalone is the “traditional” approach that is being challenged and seems to be losing out. Freemium seems to end up looking like the pay per use type scenario in that any company starts with the free element to play with the system, enabling the seller to get in, then when the company decides to use it systematically they pay the subscription tied to usage – so back to a subscription / usage model. Basically, this for me is like test driving cars before buying – clearly you don’t expect to pay for that. The do-it-yourself model is definitely seen as “not a good idea” ( specialist in-house solutions based on a few experts, heavy unique maintenance , high risk to fail to update at pace needed etc ) unless you are one of the players selling the IT cloud based enterprise system to companies. These guys interestingly, often build their business models up with heavy doses of core open source offerings, or make deals with each other – so are often not tied to the same business and hence financial model as they are selling to the rest of us.

So, let’s try and use the above car leasing as a framework of tests to see if there is an issue in the world of companies moving to digital / Cloud based enterprises. My focus is companies undergoing a transition where they are moving both underlying IT infrastructure and usually also product offerings to be cloud based – often called digitalisation or moving to the cloud based economy. Usually these companies have some strong business model based around selling one-off products and or services – so will have strong focus on Profit & Loss and Balance sheets , typically around turnover, contribution margins, fixed costs, EBIT, CAPEX, Cash Flow and so on.

The first test is – are we locking ourselves into a fixed monthly outgoing that is high AND is the flexibility to change or vary this an illusion?

For me personally this is my Netflix subscription vs my dropbox subscription argument. Are companies buying cloud services that lock them in? As far as I can see, in my limited experience, companies play with a lot of these services, but eventually decide for reasons of efficiency, to scale up a few across the company. These immediately are configured to the companies needs and essentially the company locks itself in. It seems like its Dropbox all the way to me. As the picture at the top of the article shows – we are not talking about one or two systems, processes or value add elements, but many packages. Each one seems a reasonable fixed cost to take on board, but quickly they add up to a large fixed cost to the company. Going out every month. So, high fixed costs. I would love to know what company IT budgets look like as the company moves to a cloud based approach, and how much the fixed expenditure on software subscription license jumps – but I am sure it’s a big jump – a bit like moving to leasing. Of course, the total cost argument is used – less people in maintenance and so on – but bottom line – jump in fixed cost outgoings.

The second part of the first test is flexibility. The mitigating idea is that these cloud-based product/services we pay for become more like our direct material variable cost – we gain flexibility as the company situation changes. Here to some extent I agree, but I don’t see this like the variable cost of a product. It’s something like a blended fixed/variable cost that impacts the profit and loss, as well as the balance sheet, tying up cash.

It is tied to usage drivers so eventually there will be a cost reaction as company’s sales and traditional fixed costs (usually people and related costs) change. But the lock-ins are big – discounts are built-in that mean it’s not a linear reaction. There are many different cost drivers built in (as mentioned above), so changes to monthly fees are slow and not immediate and you may have to fall a long way before you can impact the fixed monthly outgoing. It is a tax that is likely spread across turnover, number of people, amount of usage of the service (like storage or simulations) that indirectly and weakly link to changes a company might see in the market. So for example, reducing the workforce will have an impact on usage tied to people – but no guarantee it’s a simple and quick response as only part of total monthly fee ties to people usage as driver and the discount likely means a big headcount reduction is needed to move the needle . All this means slow reaction that probably will be way too little, too late to help any quarterly or even yearly changes in the company’s fortunes. So not totally rigid – but not good.

What about flexibility to change? the car service skipped or buy a cheaper used model idea from car ownership? This also seems not possible. If you have a drop in contribution or drop in profitability or whatever – you’re not going to be able to look to your cloud costs to help you out. There is no time out available on the fixed outgoings and no sell and buy a cheaper model.

In summary to the first “Car Leasing Bubble” test. Yes, to fixed cost outgoings increasing, a pretty weak argument that the outgoings will scale costs up and down over time, based on usage, and Yes to no flexibility in the leasing model itself to “skip a service”. You’re on the hook.

So on to the second test – do we buy too much – or “upgrade” to a car we would normally not buy. Well in terms of the availability of cheap capital – my impression is that if we think that people at an individual level have access to cheap money – that’s nothing compared to what companies with reasonable balance sheets can access. Of course, companies tend to think a lot more about spending money – so tend to be much more careful. However, the cloud based systems we are talking about , for me, seem to be premium product only across the board. The only product available is the one that has all the functions you can think of, so that it can configure to a wide range of industries and applications, so you always are buying a premium package with many features you will never use. In addition the product will usually belong to a family of modules that you are also encouraged to buy. Result seems to be we always pay for the trade up model. So the second test also seems to indicate a problem.

Lastly does this cost model and all these many systems we are now paying monthly fees to, expose us to a greater market risk, or even worse actually help accelerate the risk. This is clearly not so simple to answer as the car leasing situation.

One risk is clear at the company level, and that is companies are tied to a high monthly outgoing that is not so flexible. This exposes companies to rigidity rather than flexibility in their cost structure, making them less, not more, able to adjust as their fortunes vary in the market. This will be amplified if the company business is around one-off sales and is transitioning – as it has no financial language or performance systems to offset this increasing fixed outgoings against normal quarterly variations in the markets and the resulting variations in margins, and other targets it sets itself.

Another risk that is at a market level, is bankruptcy of the IT enterprise system supplier. This will happen to some. Given the fact that many of these systems end up being like my Dropbox – this becomes a company critical issue to the companies using the system. A clear warning trend for this risk will be that especially larger companies will go for vendors that are “too big to fail”. Like Microsoft or Salesforce or SAP, escalating the problem of tying a huge percentage of larger companies in the hands of a few platform players. This is because of my Dropbox effect – second sourcing or similar tactics that are the mainstay of risk mitigation by purchasing are no longer possible. Clearly this consolidation effect does build up a potential for a bubble – in that shocks to a few key vendor players can have an over proportional effect on companies. For example, sudden jump in costs charged by a vendor in trouble would impact profitability and cash flow disproportionately across many industries, as would a bankruptcy of one of these big players – that would be like a mini bubble bursting, rippling across different industry segments. Is this likely? It’s certainly possible, so in that sense, there is a market risk that increases as this financial model is deployed, building in a bubble. It doesn’t seem very likely though – the big players, although have accelerated fast into the markets – seem very resilient so far. And in the enterprise space, if new technology disruptions occur like the current Salesforce and other vendors of cloud-based CRM taking over traditional CRM suppliers – they occur slowly and it becomes more a lifecycle adoption problem that companies plan for and manage (even if very painful).

What does seem likely is that companies will find themselves in a much more rigid cost structure than they are used to – locking in a cost to do business. In non-volatile conditions, it should work – companies will clearly drive productivity and efficiency savings to make up for the additional cost. But it does open questions about competitiveness and ability to handle volatility in a financial sense. It will be harder for companies to make corrections – they will have to cut deeper into their workforce or other costs to compensate for market changes than they are used to, they will have less control over contribution margins, profits and cash. Winners will be those that integrate and utilize the new functionality and cloud environment best – but that means those that integrate the systems and make them part of their business model best – paradoxically make them more dependent, not less.

So overall – maybe not a fiscal cliff – but it is a steep path next to a drop of some sort. It seems we have a period now of many companies adopting the same approach. So there is a risk of a dominant model for financing digitalisation emerging, as as concluded above, it does seem to share many characteristics that are common with a sector financial risk bubble.

As a result, we could be in for a period of relatively high cost structures despite acceleration of automation through AI, machine learning, robotics (both SW and physical robots) etc., so we end up with this strange effect of less jobs, seemingly increasing productivity in the companies, but no real outward impact on competitiveness, prices and so on.

Note , this is a review only of the financial model dominant around digital / Cloud IoT, not of the technologies themselves. I do not advocate we do not digitalize, or even slow down. However, we may need to think carefully about transition strategy – and what options and alternatives we have.

There are alternative strategies companies could take – I outlined one at end of “How do companies compete when Industry 4.0 hits?”

I would , as always , love to hear your comments and thoughts , if you get this far